eWHT explained

The current Relevant Contracts Tax (RCT) and Professional Services Withholding Tax (PSWT) withholding tax regimes have limitations. These can impose additional administrative burdens and business costs on withholders, and those subject to withholding.

These limitations include:

- Withholding tax rates which are not tailored to individual taxpayers and do not reflect the actual amount of tax due.

- A lack of integration between the business systems of the taxpayer and Revenue systems. Integration would facilitate the efficient and simplified transfer of information.

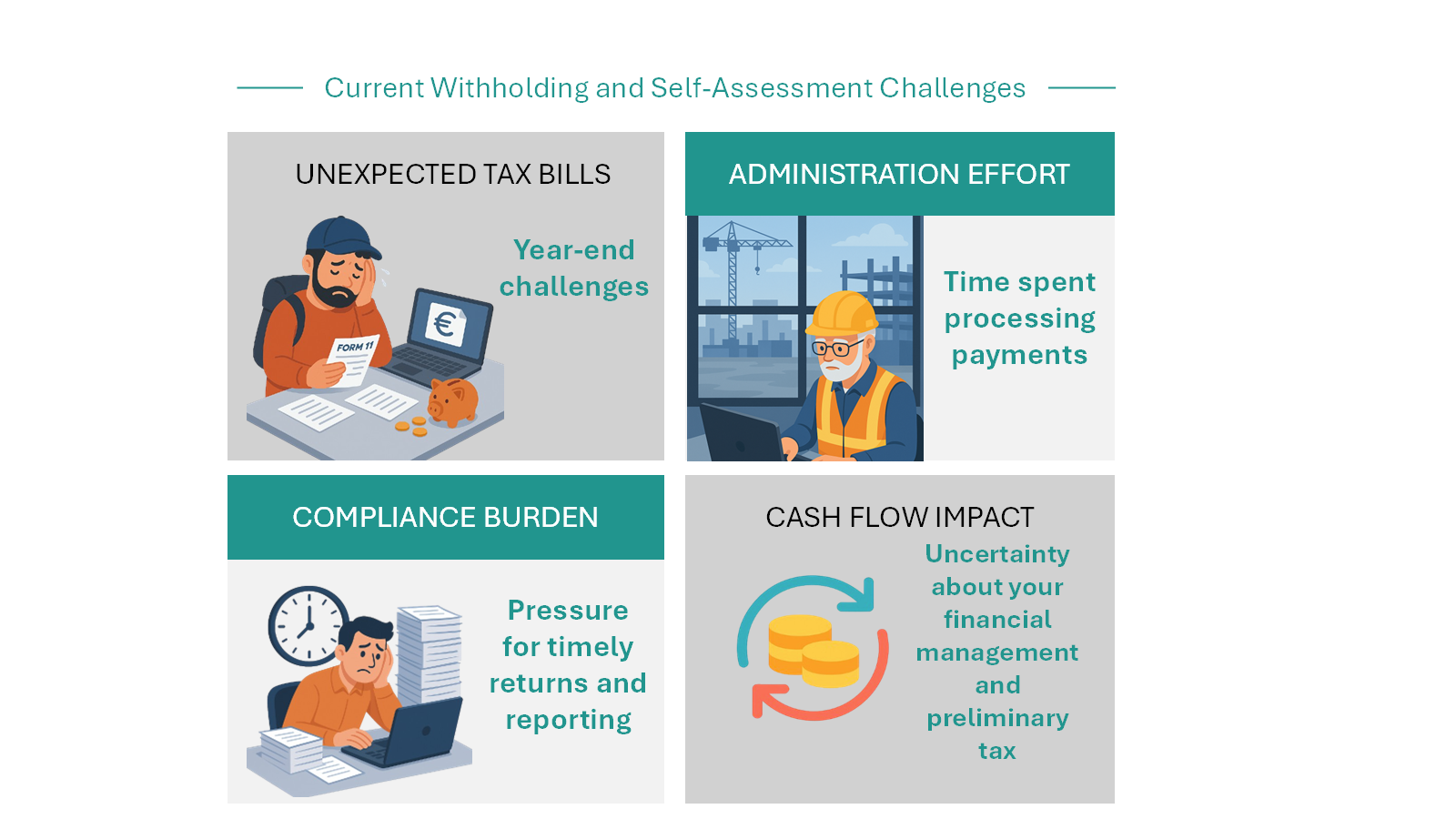

The constraints outlined contribute to the following pain points in the current RCT and PSWT withholding regimes:

- Manual and time-consuming reporting of payments subject to withholding outside of business systems.

- Cash flow issues where tax withheld does not reflect the actual amount of tax due.

- Manual and time-consuming claiming of in year, and end of year refunds from Revenue.

- Manual calculation and payment of preliminary tax due.

- Lack of certainty during the year on the amount of preliminary tax due.

- Lack of visibility of an individual’s effective tax rate and tax position through the tax year.

- Where the withholder operates both RCT and PSWT, they engage different withholding and reporting requirements. This increases complexity and administrative burden.

Key Features of eWHT

eWHT proposes a move towards real-time taxation, right tax at the right time for self-employed taxpayers, subject to withholding. Revenue is committed to constantly refreshing its IT systems and innovating in the technology space. The new withholding tax will operate in a fully electronic format. Revenue will engage with software providers to develop a real-time data exchange process between Revenue’s systems and taxpayer’s systems.

Features of this withholding tax modernisation proposal include:

- Application Programming Interface (API)

Revenue will develop a suite of APIs to facilitate the automatic real time flow of data between Revenue and eWHT stakeholders. This flow will be facilitated in the natural business systems of taxpayers. The use of APIs will provide enhanced efficiency and reduce the administrative burden.

- Automated preliminary tax pre-payment

Tax withheld will be credited against the preliminary tax liabilities of the taxpayer. This includes self-employed individuals (including partners), self-assessed corporates, and self-assessed non-corporate entities.

- Pre-population of tax returns

Data reported to Revenue, will be used to pre-populate a self-employed individual’s Income Tax Return. This will include data reported by third-party withholders and by taxpayers themselves.

- Personalised Deduction Rate (PDR)

A Personalised Deduction Rate (PDR) rate will be calculated by Revenue for self-employed individuals. The PDR will be applied to each payment and will ensure that the amounts withheld on each payment are then more reflective of the actual tax liability due on that payment. The rate will be calculated, and updated on an ongoing basis, using information such as the individual’s income, expenses and personal tax credits, rate band etc. This is similar in nature to how the Revenue Payroll Notification (RPN) is applied to employment income through the PAYE system.

Revenue intends to facilitate a software solution (including an API) to allow the voluntary reporting of data to the PDR calculation. This includes reporting of other incomes and tax-deductible expenses by self-employed individuals. While reporting the data will be optional, reporting will improve the accuracy of the PDR calculation.

- A new flat rate of withholding

A new lower flat rate of withholding will apply to corporate and non-corporate entities (non-individuals).

The withholding tax system will be designed to be scalable to additional suitable service providers in the future.

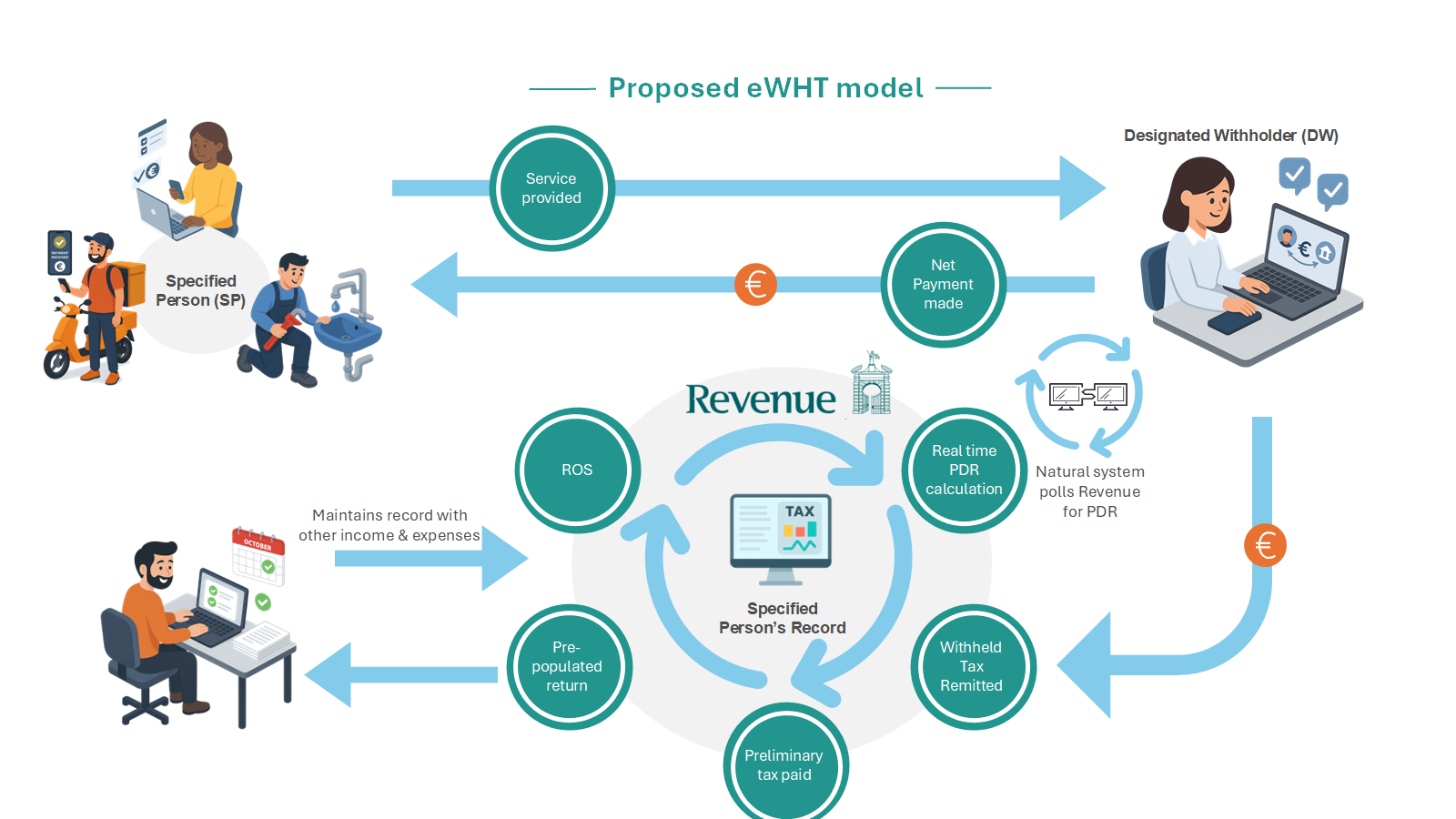

- Specified Person (SP) provides services to a Designated Withholder (DW).

- Prior to making a payment, the DW’s payment system will ask Revenue for the correct rate at which to withhold. This communication between systems occurs via an API without the need to login to ROS.

- The PDR will be calculated by Revenue. This will use real-time income information from the DW, and other income sources and expenses details reported by the SP.

- Revenue will provide a PDR in real-time to the DW.

- DW will apply that PDR rate to the payment due to the SP.

- SP receives payment for services, net of withheld tax.

- SP’s Revenue record is automatically updated with details of the payment made by the DW and the tax withheld.

- A pre-populated simplified Income Tax Return is made available to the SP for checking and approval.

- Tax agents will be able to engage with all eWHT services on behalf of their clients.

Benefits

Implementation of this modernisation proposal will yield the following benefits for taxpayers and Revenue:

- Reduction in administrative burden, economic costs and labour associated with taxpayers and businesses meeting their tax obligations. This is achieved by seamlessly integrating tax compliance into business processes. These efficiencies will enable the self-employed and businesses to focus more on their business.

- An additional and simplified way for self-employed individuals subject to withholding to meet their annual preliminary tax obligations.

- A reduction in the balance of preliminary tax due for self-employed individuals at their annual preliminary tax due date. This is due to withholding tax being a payment on account.

- Application of a Personalised Deduction Rate (PDR) for individuals and the introduction of a new flat rate of withholding for non-individuals provides:

- potential for better cashflow management

- reduction in the need for end of year, and in year interim refunds (PSWT).

- Increased transparency for taxpayers of their real time tax position.

- Enhanced cash flow management for the Exchequer.

- Right tax collected at the right time.

- Increased visibility for Revenue into income streams, helping identify non-compliant taxpayers.

- Improved compliance rates and reduced tax evasion in the targeted sectors.

Additionally, the modernisation of existing withholding taxes allows opportunities to be capitalised on:

- Leveraging technology to further real-time data integration and transparency, VAT Modernisation, eInvoicing, and pre-filled tax returns.

- International cooperation: Aligning with DAC 7, OECD and other global initiatives.

- Education and awareness: Ensuring taxpayers understand their tax obligations and that Revenue meets taxpayers on their terms.